[Off Grid Money] Take on Debt…And Do It Now!

From our friend RC Peck, a great advisor and knowledgeable on ‘off grid’ investing:

I think you should take on debt, and I think you should do it now.

Wait, what? Isn’t debt bad?

Ben Bernanke wants you to take on debt.

The U.S. Government wants you to take on debt.

Banks want you to take on debt…

…And I think you should!

Let me tell you why.

I think this is a once-in-a-lifetime event. Though the phrase “once-in-a-lifetime” gets thrown around alot, and is a very “hype-y” phrase in the advise world, I really do feel this is a once-in-a-lifetime event.

You should be taking on debt and not paying it down.

In fact, I do not think you should pay off your house.

I think you should be refinancing it, and taking out up to 80% on it.

Why?

Because debt is so cheap. Money is so cheap to borrow right now. Let me show you why. Below is a price chart that represents 100 years of U.S. mortgage rates.

You can see in the lower right hand corner of the price chart that in the past 100 years, mortgage rates have never been as low as they are today.

Now this price chart does not go back to the 1800s or the 1700s, but I am willing to wager that mortgage rates weren’t as low as they are today.

Look at the next chart below. It shows interest rates going back to 1791. As you can see, interest rates were much higher back in the late 1700s and the early 1800s, than they are today.

Interest rates are so low, that the government is just begging you to refinance and/or take on more debt.

This is why I do not want you to pay off your house. If your house is paid off, I think you should refinance it and take that money out or just lower the rate.

So are there any opportunities left in the real estate market?

The first thing you should know is that you have not missed the buying opportunity. If you want to invest in real estate via investment properties in single-family homes, then you might want to check out the chart below. It shows the five most undervalued metropolitan statistical areas or regions in the U.S.

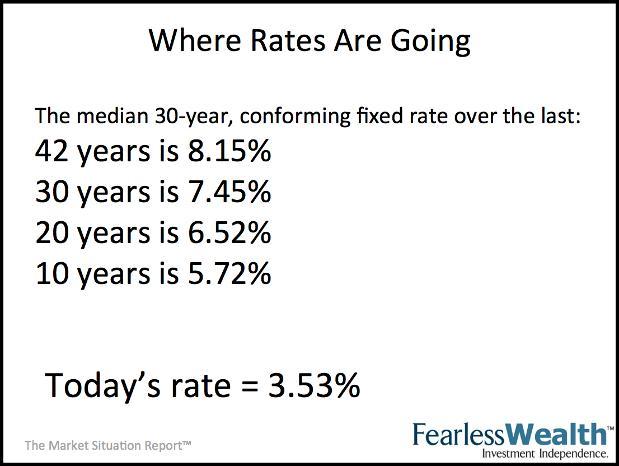

Next, I want you to know just how low rates are today. To do that, I want to show you the next image of interest rates going back more than 40 years.

Look at the chart below and just be in awe.

Notice that the median 30-year fixed, fully amortized, conforming loan rate over the past 42 years is 8.15%. Wow.

Go back 30 years to 1983, and the average rate was 7.45%.

Go back 20 years to 1993, and the average 30-year rate was 6.52%.

Go back 10 years and the average rate was 5.72%.

Where are we today?

We are at 3.53%!

I want you to think about this for a minute. You can borrow up to $417k for 30 years, at a rate that is lower than inflation in certain parts of the country. Even if 3.53% isn’t lower than inflation where you live, that is an extremely low cost to pay to borrow money; especially if you consider that you get to write-off your interest expense on your taxes. That means that 3.53% rate is really closer to 3.0% for some people. Three percent!

The bottom line…the government wants real estate to go up in price so people feel richer.

I think you should take advantage of this. I think you should take on debt if you have paid off your house. I think you should pull that money out and put it to work for you.

In the upcoming March Monthly Strategy Gathering, I will tell you exactly where you can get a non-volatile, predictable 10% on your money, outside of the craziness of the markets.

Don’t worry; this choice is completely liquid, very transparent, and has more than $900 billion invested in it today.

The government wants you to take on debt at a 3% rate AND I will show you how to invest that money in a 10% simple investment.

Together, we are growing and protecting your wealth,

RC Peck, CFP

Fearless Wealth | Investment Independence

Helping Individuals Reach Financial Independence Sooner, Faster, Safer.

RC’s Note: The one question I hear most often from my readers is “How can I safely get more income from my investments…without volatility?” Well, I’ve found one safe opportunity supported by more than 400 of America’s biggest and richest organizations. It enables you to collect 10% or more in a safe, proven investment. I’m calling it “The 10% Retirement Plan” and I’d like to show you how it all works. Click here to learn more.

0 comments